Important Announcements

Important Announcements

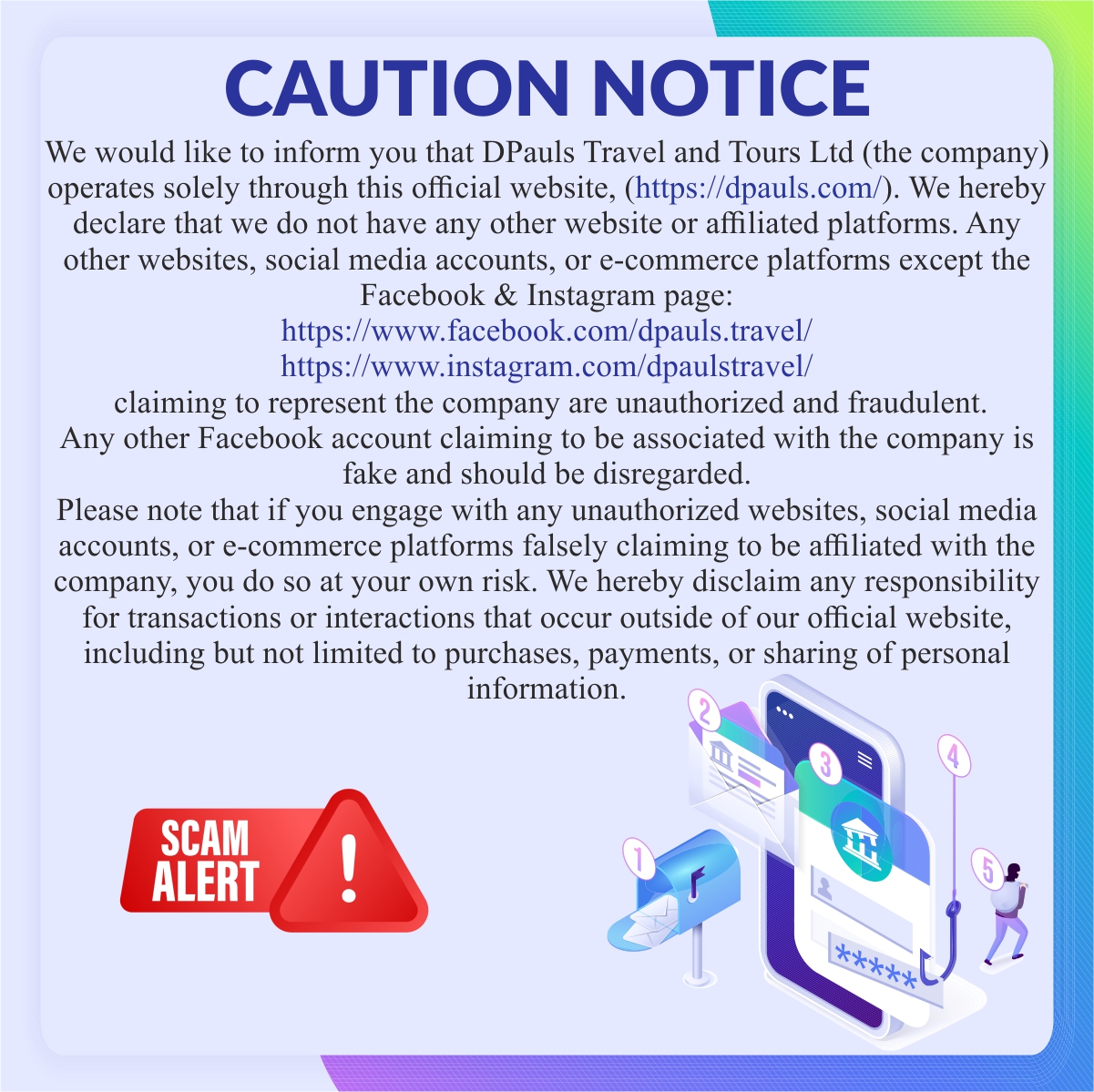

Caution Notice

We would like to inform you that DPauls Travel and Tours Ltd (the company) operates solely through this official website, (https://dpauls.com/). We hereby declare that we do not have any other website or affiliated platforms. Any other websites, social media accounts, or e-commerce platforms except the Facebook & Instagram page:

https://www.facebook.com/dpauls.travel/

https://www.instagram.com/dpaulstravel/

claiming to represent the company are unauthorized and fraudulent.

Any other Facebook account claiming to be associated with the company is fake and should be disregarded.

Please note that if you engage with any unauthorized websites, social media accounts, or e-commerce platforms falsely claiming to be affiliated with the company, you do so at your own risk. We hereby disclaim any responsibility for transactions or interactions that occur outside of our official website, including but not limited to purchases, payments, or sharing of personal information.

Book Flight Tickets, Holiday Tour Packages, Sightseeing, Hotel Booking | DPauls Holidays

Book Holiday Packages, Flight Ticket, Sightseeing Tour, Hotels, Transfers & Bus at DPauls.com. Get the Best Deals on Flights Booking, Tour packages on India & International Travel.

dpauls.com

Important Covid Update

In view of the COVID-19 situation, different country/state governments have laid out their respective protocols for passengers coming to their Country/state as visitors/tourists. Before you travel, make sure to read and understand the complete guidelines of the country/state you are travelling to, especially whether there is a mandatory requirement for RT-PCR test, related requirements and acceptance of vaccines. Kindly verify your vaccine, vaccine doses, vaccination certificates, dates of vaccination and their acceptance at the visiting country/state before you travel. Kindly go through the complete guidelines for adults, kids & infant passengers before starting your journey. Please comply with the same so your travel plans are not affected. Kindly go through the government guide/website for recent regulations. Air Suvidha Self Declaration Form to be mandatorily filled by all passengers arriving in India. Visit the website: https://www.newdelhiairport.in/ enter all details on the Air Suvidha portal https://www.newdelhiairport.in/airsuvidha/apho-registration Passengers are advised to check the latest guidelines from the country / state websites or the airlines concerned before starting their journey.

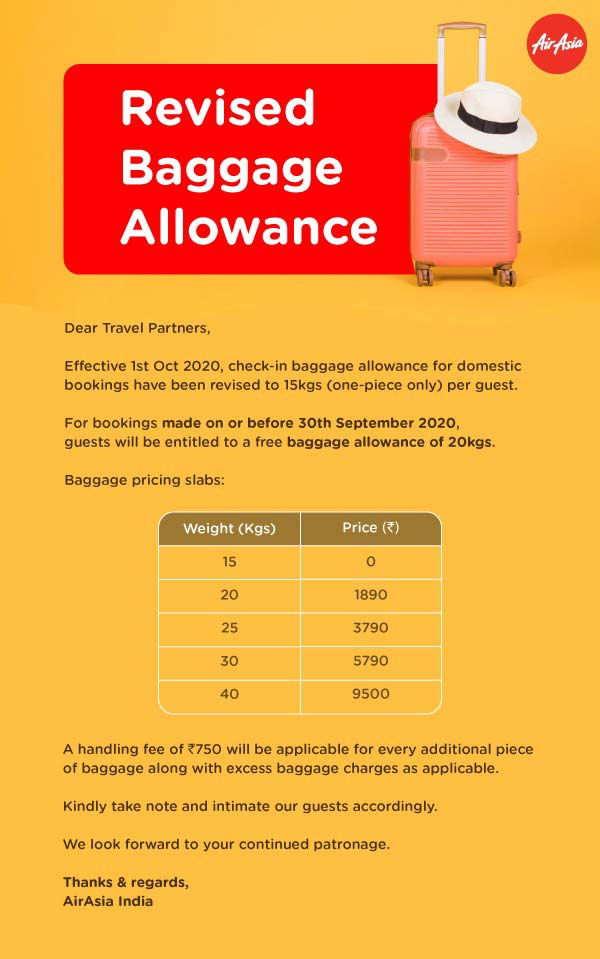

REVISED BAGGAGE ALLOWANCE- AIRASIA DOMESTIC

REVISED BAGGAGE ALLOWANCE- AIRASIA DOMESTIC

REVISED BAGGAGE ALLOWANCE- INDIGO AIRLINES

REVISED BAGGAGE ALLOWANCE- INDIGO AIRLINES

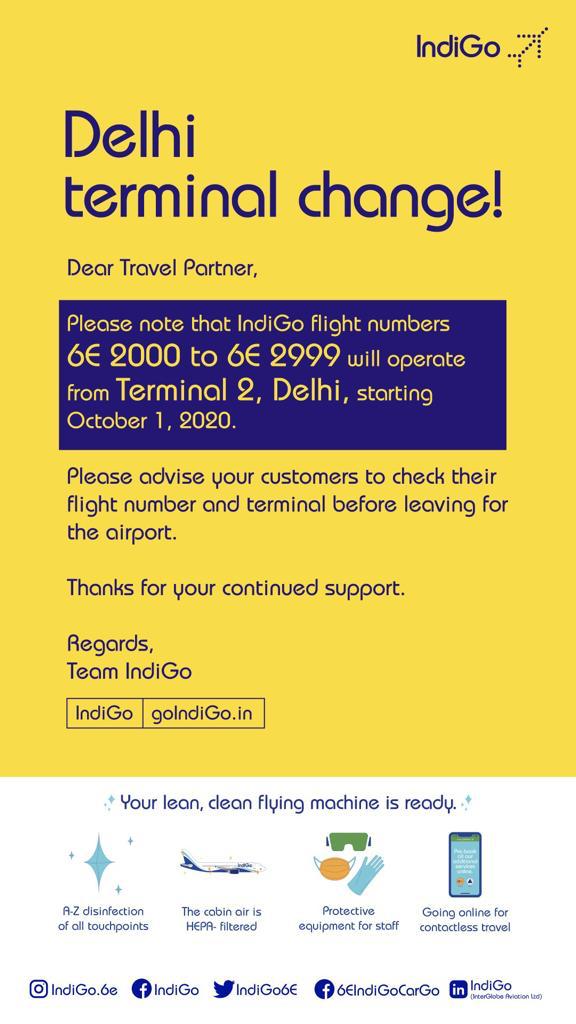

INDIGO - TERMINAL CHANGE

INDIGO - TERMINAL CHANGE

GOAIR - TERMINAL CHANGE

GOAIR - TERMINAL CHANGE

OPEN - ENTRY WITH PRIOR APPOINTMENT ONLY!

OPEN - ENTRY WITH PRIOR APPOINTMENT ONLY! Keeping in mind the safety & security of all our customers and staff members, we are functioning for available and permitted Domestic Destinations with limited staff with a lot of caution and safety. We do not encourage visiting our office unless there is a requirement to do so but it has to be with prior appointment. At present International flights are not operating in full swing and tour destinations. We are still available for any queries over the phone, WhatsApp & email. We are functioning for available and permitted tour destinations but with a lot of caution and safety measures Our ticketing team, as well as other relevant teams can be reached for assistance on the helpline numbers, and they would be happy to assist you for any requirements.

HELPLINE NUMBERS & CONTACT INFORMATION

HELPLINE NUMBERS & CONTACT INFORMATION

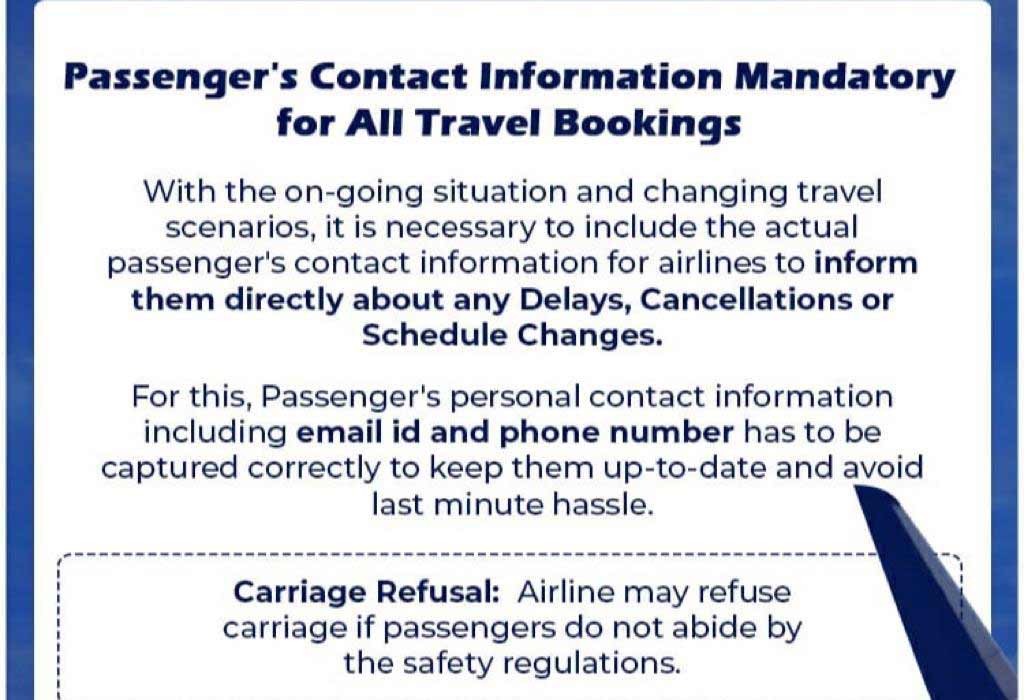

IMPORTANT INFORMATION FOR AIR TRAVEL

IMPORTANT INFORMATION FOR AIR TRAVEL

WEB CHECKIN INFORMATION- SPICEJET

WEB CHECKIN INFORMATION- SPICEJET

WEB CHECKIN INFORMATION- SPICEJET

WEB CHECKIN INFORMATION- SPICEJET

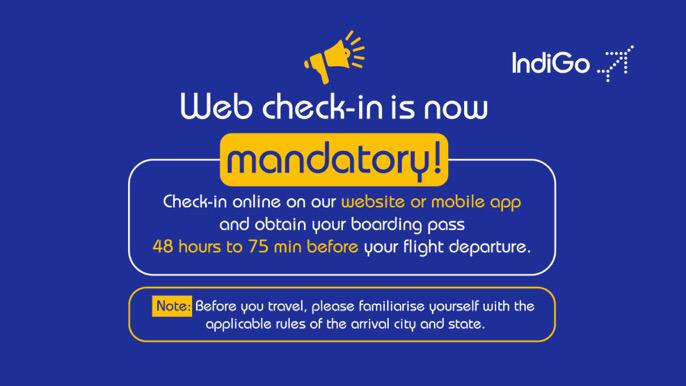

WEB CHECKIN INFORMATION- INDIGO

WEB CHECKIN INFORMATION- INDIGO

TERMINAL INFORMATION- SPICEJET

TERMINAL INFORMATION- SPICEJET

TERMINAL INFORMATION- INDIGO

TERMINAL INFORMATION- INDIGO

New Rules For Contactless Air Travel

New Rules For Contactless Air Travel

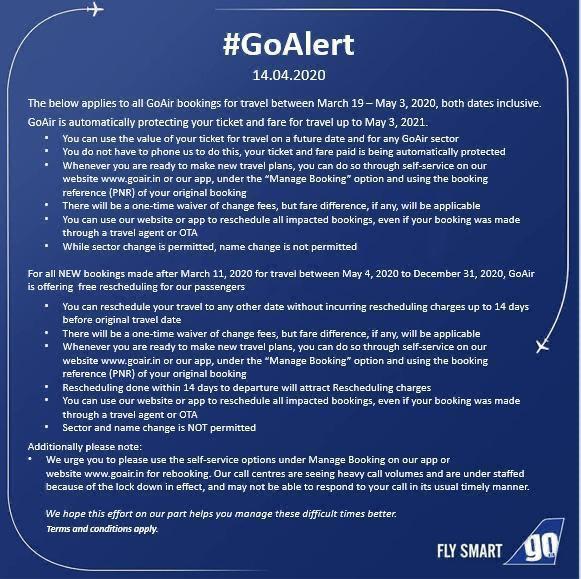

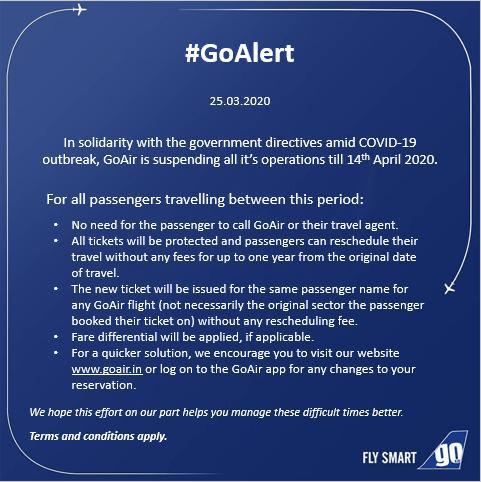

GO AIR UPDATE 14 APRIL 2020

GO AIR UPDATE 14 APRIL 2020

TRADE NEWS - ETHIHAD AIRWAYS - 27 MARCH 2020

TRADE NEWS - ETHIHAD AIRWAYS - 27 MARCH 2020 Dear All, Please find the updated trade rebooking policy. Changes include: · Etihad Credit - travel extended until 31 July 2021 · Etihad Credit - Introduction of 5000 bonus Etihad Guest Miles Please visit https://www.etihadhub.com/ for more information which is also updated with more FAQs. Etihad Airways

GARUDA AIR

GARUDA AIR

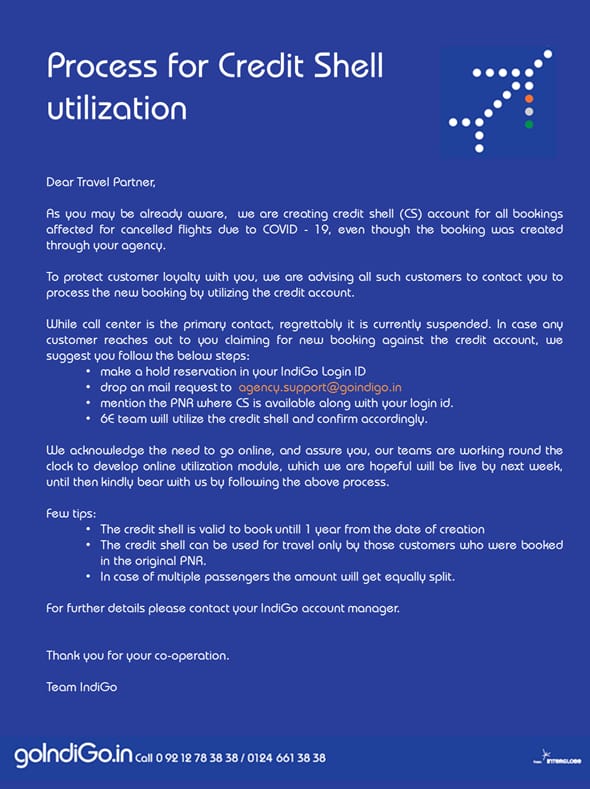

Process for Credit shell Utilization

Process for Credit shell Utilization

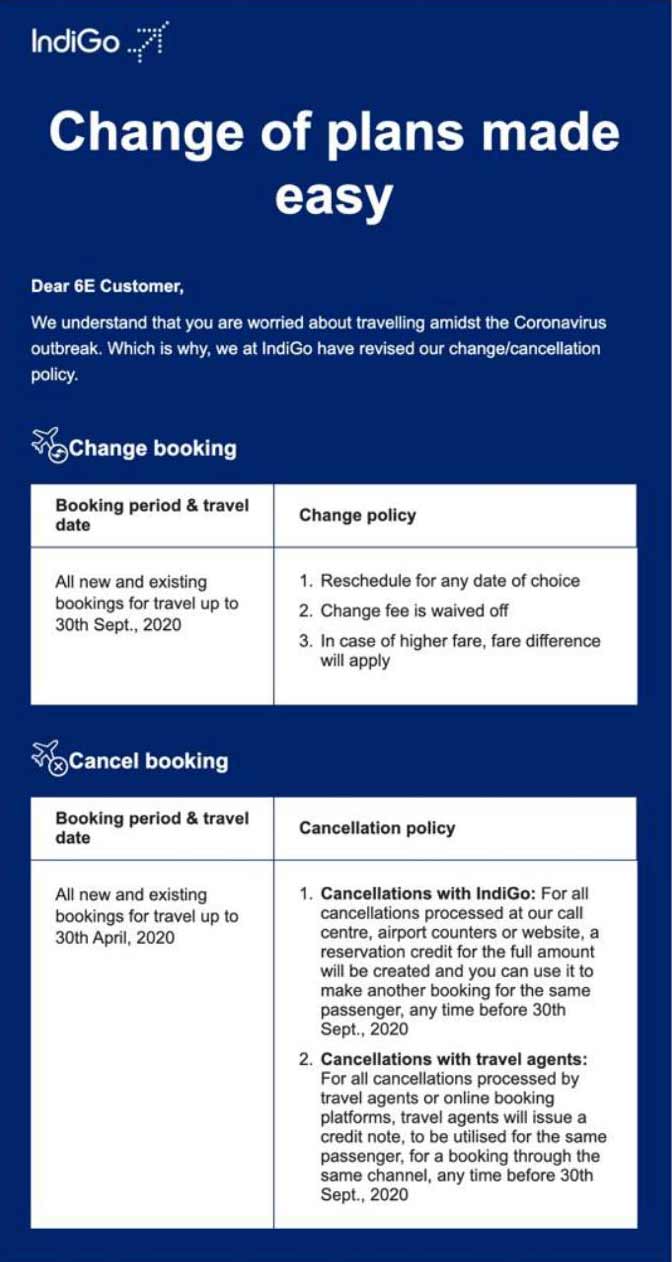

INDIGO

Change of plans made easy

#GOALERT

GO ALERT

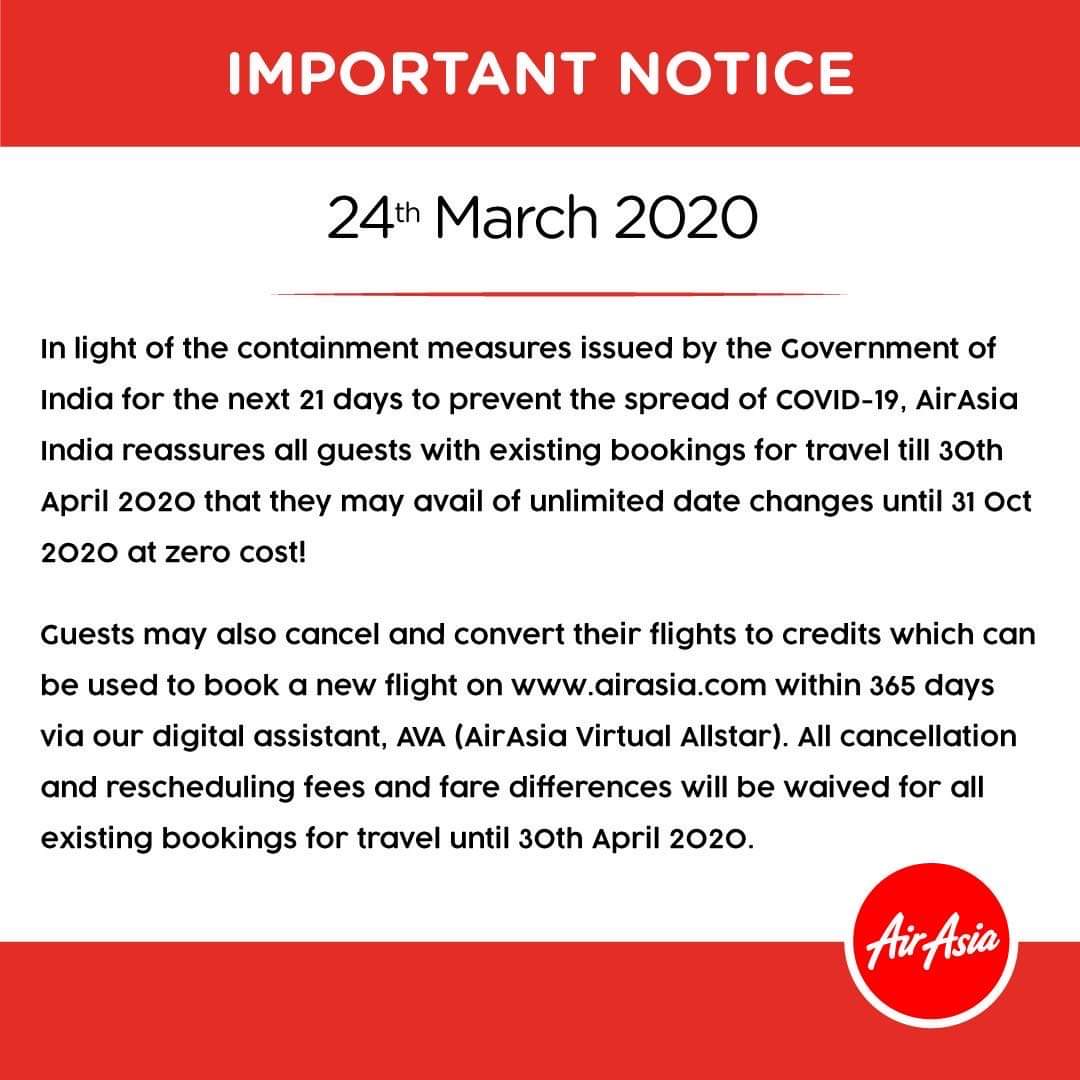

Air Asia

COVID-19 UPDATE

HELPLINE

We all at Dpauls are committed to serving you and are available for any assistance to all our customers. Keeping this situation in mind we have advised our team to avoid using public transport and stay at home and work from home. All of us are available on their phones. We are sharing few numbers in case of any EMERGENCY. Please share your booking reference number. Request you please do not call these numbers for general information. Ticketing: 011-66777271, 011-66777154 International Tours: 011-66777169, 011-66777282, 011-66777257, 011-66777191 Domestic Tours: 011-66777105 Europe, USA & Australia: 011-66777282, 011-66777181, 011-66777194 Note: Please do not call these numbers for general information.

COVID-19 UPDATE

COVID-19 UPDATE Dear Customer, Keeping the safety of our team members in mind, we are not operating from office locations & our office will be shut for 2 weeks. This is to encourage Social Distancing the advisory by the Government & Honourable Prime Minister Mr. Modi. You may not get the reply of your email, in case you have something really urgent please send mail to helpline@dpauls.com. We all at Dpauls are committed to serving you and are available for any assistance to all our customers.

COVID-19 UPDATE: FLIGHT BOOKINGS/ REFUNDS

COVID-19 UPDATE: FLIGHT BOOKINGS/ REFUNDS Dear Customers, This is a very important message and needs your attention and cooperation. We will give refunds after we receive from them from airlines. Please do understand the airlines conditions and co-operate with us. In this situation, each organization is trying its best to minimise losses while providing customer service. Many of the top selling airlines are allowing Free date changes not giving full refunds. Most airlines have stopped giving full refunds and for those who have not, they are expected to do so soon. Please do not create panic in our call center, instead, help yourself by calling airlines where airlines approvals are required to speed up the refund for yourself. It is expected that all airlines will block refunds and move for date change only. (Because airline policy on refunds is changing everyday) We will give refunds after we receive from them from airlines. Please do understand the airline's conditions and co-operate with us.

IMPORTANT ANNOUNCEMENT: TOURS/BOOKINGS AFFECTED BY COVID 19

IMPORTANT ANNOUNCEMENT: TOURS/BOOKINGS AFFECTED BY COVID 19 1. We urge you not to take tour causing health hazard just because there is the financial impact of tour booking. 2. Currently, there is distress and the haphazard situation arising due to various advisories and news published through print, electronic & social media, which is causing confusion amongst us all. Nobody is certain about the situation of uncertainty that has cropped up due to COVID 19. 3. It is causing lot of pressure on everyone where there is flight cancellation too. 4. There are advisories to avoid non essential travel from the Government and hence we have accordingly not operating tour till 15th of April 2020. 5. Even Director General of Civil Aviation (DGCA) has asked airlines to refund money or in lieu thereof to provide tickets for alternate date. 6. Since most of the airlines are in the process of following DGCA guidelines but we do not know exact outcome till the process is complete at their end. 7. We therefore reiterate do not venture yourself to endanger your life due to prevailing health hazard of traveling during outbreak of COVID 19 pandemic. In short don’t give preference to saving financial loss over financial hazard. 8. Many VISA cancellation or restrictions attached to it related announcements are happening in light of COVID 19 pandemic, kindly keep yourself abreast with the latest such announcements. 9.Many countries have been identified by our Government from where travelers who are coming from those countries need to be QUARANTINED for about 14 days or so on arrival to India, kindly keep yourself abreast with the latest such announcements.

NOTICE FOR SINGAPORE VISA

NOTICE FOR SINGAPORE VISA 1. The processing fee for each visa applicant is S$30. 2. The service fee charged is Rs.300/- + GST. 3. The applicant would be issued with a receipt listing in the visa fee and service fee upon successful payment. 4. The applicant would be notified by the authorized visa agent on the outcome of visa application. Note: When converted to Indian Rupee, the visa processing fee may vary according to the prevailing exchange rate at the time of application.

Important Note:

Important Note: Please note that we do not have any Branch or Franchise neither do we authorize anyone to collect payments on and our behalf nor we authorize anyone to use our name, logo, email ids i.e @dpaulstravel.com, @dpauls.com or our website. If in case of any suspicious email or suspicious person contacting you, personating to be speaking from our company, please confirm the same by reaching our office. Before making payment kindly check details mentioned on website link- Terms and Conditions →

UPDATE ON REFUND FOR JET AIRWAYS

UPDATE ON REFUND FOR JET AIRWAYS Dear Customers, As you may be well aware, there is an unfortunate situation created by the suspension of operations by Jet Airways. Not only has this adversely affected the travel plans of thousands of fliers, it has led to a virtual flood of refund requests. As per procedure, the payment of tickets issued through us goes to the airline. When the cancellation request is received by us, we process the same from our end and send the same to the airline, after which the airline processes the refund back to our account. This procedure takes some time. Moreover, in view of the current situation, we are unfortunately not in a position to advise you the exact timeline of the expected refund. However, rest assured that DPauls will do all possible to pursue the refund cases with the airline, and from our end, we will immediately initiate the refund once the same is received from Jet Airways. In the interim, your patience and understanding of the situation would be highly appreciated.

UPDATE ON JET-AIRWAYS

UPDATE ON JET-AIRWAYS Dear Trade Partners, As you are aware, there is an unfortunate situation created by the suspension of operations by Jet Airways. Not only has this adversely affected the travel plans of thousands of fliers, it has led to a virtual flood of refund requests. As per procedure, all refund requests received by us are processed at our end and sent to the airline. Thereafter, the airline issues the refund to us and we further refund the amount to you once we get the same in our account. This procedure takes some time. Moreover, in view of the current situation, we are, unfortunately, not in a position to advise you the exact timeline of the expected refund. We do, however, assure you that DPauls will do all possible to pursue the refund cases with the airline, and from our end, we will immediately initiate the refund, once the same is received from Jet Airways. We would further like to inform you that we are not in a position to adjust the refund amounts against your ongoing / future bookings, since the refund amount is yet to be received by us from Jet Airways. In the interim, your patience and understanding of the situation would be highly appreciated.

Important Note:

Important Note: Please note that we do not have any Branch or Franchise neither do we authorize anyone to collect payments on and our behalf nor we authorize anyone to use our name, logo, email ids i.e @dpaulstravel.com, @dpauls.com or our website. If in case of any suspicious email or suspicious person contacting you, personating to be speaking from our company, please confirm the same by reaching our office. Before making payment kindly check details mentioned on website link- Terms and Conditions →

GST Compliance

GST Compliance Whilst our offline accounting systems are already fully GST complaint, we are currently in the process of upgrading our online systems to align them with the new regulations. Till such time that this process is completed, we will be raising GST included offline invoices for the online transaction.

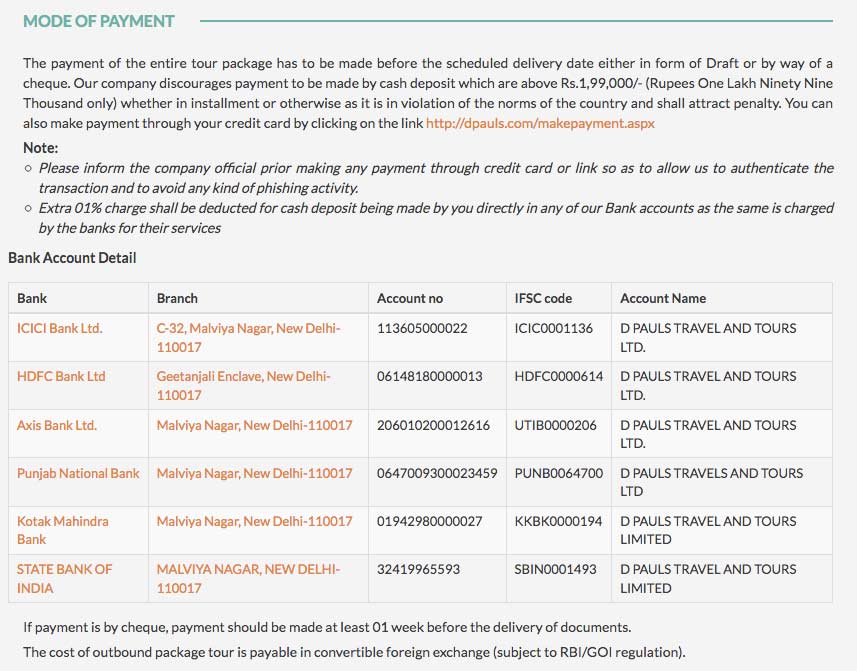

NO CASH TRANSACTION ABOVE RS.1,99,999/-

NO CASH TRANSACTION ABOVE RS.1,99,999/- Dear Customer / Travel Agents, Section 269ST in the income-tax Act that restricts receiving an amount of Rs. 200,000 or more from any person in single day, for a single transaction over multiple days etc. Penalty for non compliance is equal to amount of cash received. It is practically very difficult for voluminous business like ours to ensure compliance to such law. We will not accept any cash deposit effective 1st April 2017. Please be informed that customers/agents should not deposit cash directly in DPauls bank account.

UPDATE ON PRE-ARRIVAL REGISTRATION FOR HONG KONG

This is a reminder that effective 23rd January 2017, all Indian nationals intending to visit Hong Kong must first apply for and successfully complete pre-arrival registration online. The eligibility for applying for “pre-arrival registration” includes: Those who hold and Indian Passport valid for atleast 6 months. Those who intend to visit Hong Kong for a stay not exceeding 14 days. Upon successful registration, the India National MUST PRINT the computer generated notification slip and present the same at the Cathay Pacific / Cathay Dragan check-in counter. WITHOUT THIS NOTIFICATION SLIP, PASSENGERS WILL NOT BE ACCEPTED FOR TRAVEL. Exceptions: The following categories of Indian National can travel to Hong Kong without pre-arrival registration. • Those who have successfully enrolled for the e-Channel service for frequent visitors. They must carry a print out of the validity of the e-channel service. • Those in direct transit without leaving the transit area of Hong Kong International Airport. This also applies to ferry transfers (air to sea / sea to air transit). The online platform for pre-arrival registration is available on www.immd.gov.hk→

Caution Notice

We would like to inform you that DPauls Travel and Tours Ltd (the company) operates solely through this official website, (https://dpauls.com/). We

hereby declare that we do not have any other website or affiliated platforms. Any other websites, social media accounts, or e-commerce platforms except the Facebook & Instagram page:

https://www.facebook.com/dpauls.travel/ |

https://www.instagram.com/dpaulstravel/

claiming to represent the company are unauthorized and fraudulent.

Any other Facebook account claiming to be associated with the company is fake and should be disregarded.

Our bank account details are mentioned on our website. The link for the same is https://dpauls.com/account-details/ Kindly don't make payment in any other link or bank account.

Please note that if you engage with any unauthorized websites, social media accounts, or e-commerce platforms falsely claiming to be affiliated with the company, you do so at your own risk. We hereby disclaim any responsibility for transactions or interactions that occur outside of our official website, including but not limited to purchases, payments, or sharing of personal information.